Swoop Funding

Swoop is a business funding and savings platform enabling businesses to discover the right funding solutions across loans, equity and grants, and to identify and easily make savings. Swoop matches businesses with funding from over 1,000 providers, and identifies savings through their smart open banking technology – all in one fell swoop.

How Swoop Works

Swoop’s service features a selection of providers from whom we receive commission.

We work with our partners to offer simple and clear comparisons that allow customers to make choices on financial products and services.

How does Swoop make money?

Where services are free of charge to the customer, we receive commission from most of the companies we feature on Swoop. The payment we get will never make any difference to how much you pay for your product, service or policy.

The way that Swoop gets paid varies for the different products and services. We either get paid a flat fee when you purchase a product or use a service, a % of the cost to you for that product or service, or a percentage of the total loan amount you receive from our partner. Swoop also offers investment matching and investor preparation services. The customer decides whether they would like to progress with these services and will be provided with an engagement letter setting out these services and the associated success fees payable by the customer upon receiving investment. These services are not carried out unless the customer has provided written confirmation of acceptance of the engagement.

How we display the products and services will not be affected by the commercial agreements we have in place with our partners. We will always try to display them in a way that is clear, informative and helps you to get the best product for you.

Who do Swoop work with?

We work with a wide range of companies, comparing 1000s of products. Every company is not included in our service as not all companies want their products on comparison sites.

Funding via Loans

Swoop can match your business with a wide range of loans and other lending options.

Loan finance for business (or, more broadly, lending or ‘debt finance’) is a catch-all for any type of borrowing that you pay back, with interest and/or a fee.

If your business needs to raise money (capital) you can either borrow from a lender (i.e. debt financing) or sell a share of ownership in your business in return for capital (equity financing). You can of course combine the two.

The reason that people often use broader term ‘debt finance’ rather than ‘loan finance’ is because some types of borrowing (e.g. operating leases or supplier finance) are not actually loans and don’t appear on your balance sheet.

Whatever stage you are at in your growth story Swoop can match you to the right lending options, whether you’re looking for startup loans, working capital loans or even a loan to cover VAT costs. Your credit score isn’t impacted when you search for lending options with Swoop.

You will not pay more than going direct. Swoop is a credit broker and does not provide capital. We work with a range of companies to offer clear comparisons that allow customers to make choices on financial products & services.

Swoop may receive a commission, which may vary by product but typically in the form of a fixed percentage of the loan amount. For certain lenders, we do have influence over the interest rate, and this can impact the amount you pay under the agreement.

Funding via Equity

Take the pain out of finding investors for your business.

Swoop uses smart matching to match your business to the most suitable investors from its huge network of over 200 Venture Capital funds, Angel Networks, Family offices and Angel Investors.

Raise new capital in exchange for equity in your business.

If your business needs money to grow, you’ve the option of selling a stake in exchange for investment. Equity finance investors will have a claim on your future earnings but, in contrast to a loan, you don’t pay any interest – nor do you have to repay capital.

Equity finance could suit your business if you have an expansion plan or project that lenders such as banks aren’t willing to support, or if you want to avoid loan payments.

Your journey from start-up to successful business could involve multiple rounds of equity financing from different types of investors, e.g. business angels, venture capitalists and private equity funds. Equity finance has two obvious advantages for businesses:

• Private investors can bring additional skills and knowledge to your business – plus a useful network contacts.

• Investors, not least because they share in any upside, are motivated to make your business a success – and will be more likely to provide follow-up funding.

Swoop can match you with the most relevant equity finance for your business.

Funding via Grants

Startup & small business grants simplified.

Business grants remain a crucial source of support for many community organisations. It’s often essential in getting a new capital development off the ground, or for exploring new and innovative models to solve some of society’s toughest social problems.

Looking for innovation grants?

Innovation funds are grant funding programmes that offer financial backing to organisations and groups that are looking to research and develop a process, product or service, test innovative ideas and/or collaborate with other organisations. Is your business eligible?

What is a business grant?

A business grant is a sum of money awarded to a business to help it grow and develop – the money could be invested in training, equipment or reaching new markets, for example. Business grants are usually awarded by the government or other companies and, unlike a business loan, business grants do not need to be repaid.

What grants are available for start-ups and small businesses in the UK?

There are hundreds of business grants available in the UK, with many aimed at specific industries, community groups or types of business. If you’re a start-up or small business you’ll be able to choose from the following:

Innovation grants: these are provided by a variety of funding bodied such as Innovate UK to support innovative ideas and business growth, including those from the UK’s world-class research base.

The National Lottery Heritage Fund: provides grants to sustain and transform the UK’s heritage. This can include investment in museums, parks, historic places and cultural traditions.

R&D tax credits: these are cash payments from the government to encourage companies to carry out research and development projects that relate to science or technology.

Local Enterprise Partnerships (LEPs): there are 38 LEPs across England. These are voluntary partnerships between local authorities and businesses that provide business funding, support and guidance in their local areas.

New Enterprise Allowance: provides funding and support to those looking to start or develop a business. You need to be aged 18 or over and either you or your partner must receive Universal Credit, Job Seeker’s Allowance or Employment and Support Allowance, or you must get Income Support and be a lone parent, sick or disabled.

The Prince’s Trust: supports young people aged 18 to 30 who want to start and run their own business. As well as providing funding and resources, the Trust also provides training and mentoring.

Where can I find small business grants in the UK?

There’s a range of funding and grant options available for small businesses, depending on where you live in the UK.

Small business grants in England

There are 38 regional Growth Hubs to be found on the Local Enterprise Partnerships (LEP) Network website and these can provide funding and advice to help boost your business in your local economy.

Small business grants in Scotland

Depending on where you live in Scotland, you may be able to apply for a business grant from Scottish Enterprise, or you could be eligible for a grant from the Highlands and Islands Enterprise or local councils. Take a look at the Scottish Government’s funding advice page for more information.

Small business grants in Wales

The finance locator on the Business Wales website can help you look for grants your business may be able to apply for and it also provides information on the application process. You may be able to get funding from the Welsh government, the UK government, local authorities and charitable organisations.

Small business grants in Northern Ireland

If your business is based in Northern Ireland, nibusinessinfo.co.uk provides a number of resources to help you understand your grant options. This includes government support, as well as innovation, and research and development grants including Invest NI Innovation Vouchers, which provide access to a public sector knowledge provider e.g. University, College or Institute of Technology to work with you on an innovation project.

How do I write a business grant proposal?

When writing a business grant proposal, it’s worth keeping the following points in mind:

• Write in plain English and avoid jargon

• Be specific about what you plan to do

• Show how your business meets the grant qualifying criteria

• Be clear what success looks like as a result of taking on a grant

• Create specific aims and well-defined criteria to quantify success

• Provide evidence that your team is capable of delivering the work, as well as a return on the grant funder’s investment

• Make your budget as specific as possible

• Writing a successful grant application is no easy task and it’s well worth your while engaging the services of a professional grant writer. Speak to our grant experts who can help maximise your chances of receiving a grant.

How do I apply for a small business grant?

Swoop has a list of accessible grants you can apply for, whether you’re an established business or a start-up. You can view the many options available to you by signing up here. There’s a wide range of grants available across several sectors including grants for manufacturing, tech businesses, transport, energy, information and communication technologies, security, climate, aerospace, food, health, environment, and more.

Funding via Commercial Mortgages

Commercial mortgages & property finance.

If you’re looking to purchase or refinance a property your business trades from, a single commercial investment property, or a portfolio of investment properties, let Swoop do the hard work for you. Our team of experts will present you with all the options that are available to you for commercial mortgages, business mortgages and property investment loans.

Whatever your requirement, Swoop’s team of experts will work with you, using their knowledge, experience and skill to present your deal to lenders in the best shape possible. This reduces a lender’s perceived risk, opens up more options and reduces the interest you’ll be charged.

What is a commercial mortgage?

A commercial mortgage is a type of loan provided by a lender to a borrower that is secured by a legal charge over commercial property. Mortgages are attractive products which can be used to achieve a wide range of objectives such as contributing towards the purchase of commercial property, releasing equity to grow or invest in your business, refinancing to benefit from a lower interest rate or monthly repayments and consolidating existing debts into one manageable monthly payment.

What types of commercial mortgages are there?

There are three types of commercial mortgage:

• Owner-Occupied Commercial Mortgage

• Commercial Investment Property Mortgage

• Property Portfolio Loan

• Owner-Occupied Commercial Mortgages are provided to businesses that trade from and own the property they wish to borrow money against.

Commercial Investment Property Mortgages are provided to property owners who are investors and receive a rental income from a third party tenant or licensee. In most scenarios the rental income the property generates is used to repay the debt over a period of time.

Property Portfolio Loans are provided to property professionals and investors. The lender will take some or all of the clients property investments as security (this may be residential, commercial or mixed use property, or a combination of all within the portfolio) and provide one loan, assessing serviceability by aggregating the total income from the portfolio to meet the proposed loan repayments.

What types of businesses can get a commercial mortgage?

Thanks to a wide range of lenders and a diverse debt finance market, all of the above facilities are available to sole traders, partnerships, large partnerships, limited companies, limited liability partnerships (LLPs), trusts, self-invested personal pensions( SIPPs) and SSASs (small self-administered schemes (SSASs)

There is a restricted appetite for off-shore companies, but options are available in the market.

What do I have to do to qualify?

Each lender in the market has different criteria and appetite which are liable to change over time. SMEs and property professionals will therefore find it vital to have a specialist broker amongst their ranks to help navigate and display the options that are available at a given time. The six key areas lenders examine when assessing an application are:

• Personal and business credit history

• Experience and background of the borrowers and/or the key people involved in the business (such as the management team)

• The type of property/business you wish to purchase or refinance

• The proposed loan-to-value (LTV)

• Affordability: can the property/business afford to repay the borrowing it has requested?

• Sustainability: is the income source to repay the loan sustainable for the full duration of the proposed loan(s) facility

Don’t worry if you can’t put a tick in all these boxes, as Swoop’s specialist brokers are on hand to work with you and support you in achieving your objectives.

What are the interest rates & other costs involved?

Interest rates and other deal costs vary from lender to lender. They typically start at c. 2% with the larger traditional banks, rising up to c.12% with niche lenders for high-risk transactions. Again, this is where a broker is important to navigate the market and present to you the most competitive solutions for your specific set of circumstances by approaching a wide range of lenders with your application.

Pricing is directly linked to a lender’s perceived risk in lending the money. The lower the risk of the deal going wrong or business failing, the lower the interest rate will be. The Swoop team is trained to work with customers to structure applications and present them to the market in the best light possible, therefore ensuring you benefit from the best terms lenders can offer.

When comparing commercial mortgages, you will need to factor in the associated costs, such as:

• Arrangement fees

• Valuation fees

• Legal fees

The following fees may also be applicable:

• Exit fees

• Commitment fees

• Monitoring fees

How long will it take to get a commercial mortgage?

Arranging a commercial mortgage or a property portfolio loan, depending on the purpose of the loan, typically takes between two and six months. The more complex the deal, the longer it takes. For example, a straight refinance of an existing property to release equity can be achieved in six to eight weeks. By contrast, the acquisition of a going concern can take more than six months to complete because of the level of legal and financial due diligence that may be required.

What information or documentation do I need to apply?

Registering with Swoop will enable you to speak to one of Swoop’s specialist commercial finance team. Once we’ve confirmed that your requirements are realistic and achievable for lenders to fund, we will require the following information to start looking for deals:

• Confirmation/proof of the income that will be used to repay the debt, such as the last three years’ financial accounts for a trading business and/or lease agreements for property investment applications

• Your latest management accounts (simply connect your accounting software to your account on Swoop and the integration will quickly find the information required)

• Last six months’ personal and business bank account statements to review account activity (connect your bank account via the UK’s open banking platform to your account on Swoop and we’ll gather the information automatically)

• Business plan and/or financial forecasts

• CVs or background summary of the borrowers or management team

• A&L (asset and liability) and I&E (income and expenditure) statements for all borrowers (20+ percent shareholders)

Funding via Commercial Mortgages

Commercial mortgages & property finance.

If you’re looking to purchase or refinance a property your business trades from, a single commercial investment property, or a portfolio of investment properties, let Swoop do the hard work for you. Our team of experts will present you with all the options that are available to you for commercial mortgages, business mortgages and property investment loans.

Whatever your requirement, Swoop’s team of experts will work with you, using their knowledge, experience and skill to present your deal to lenders in the best shape possible. This reduces a lender’s perceived risk, opens up more options and reduces the interest you’ll be charged.

What is a commercial mortgage?

A commercial mortgage is a type of loan provided by a lender to a borrower that is secured by a legal charge over commercial property. Mortgages are attractive products which can be used to achieve a wide range of objectives such as contributing towards the purchase of commercial property, releasing equity to grow or invest in your business, refinancing to benefit from a lower interest rate or monthly repayments and consolidating existing debts into one manageable monthly payment.

What types of commercial mortgages are there?

There are three types of commercial mortgage:

• Owner-Occupied Commercial Mortgage

• Commercial Investment Property Mortgage

• Property Portfolio Loan

• Owner-Occupied Commercial Mortgages are provided to businesses that trade from and own the property they wish to borrow money against.

Commercial Investment Property Mortgages are provided to property owners who are investors and receive a rental income from a third party tenant or licensee. In most scenarios the rental income the property generates is used to repay the debt over a period of time.

Property Portfolio Loans are provided to property professionals and investors. The lender will take some or all of the clients property investments as security (this may be residential, commercial or mixed use property, or a combination of all within the portfolio) and provide one loan, assessing serviceability by aggregating the total income from the portfolio to meet the proposed loan repayments.

What types of businesses can get a commercial mortgage?

Thanks to a wide range of lenders and a diverse debt finance market, all of the above facilities are available to sole traders, partnerships, large partnerships, limited companies, limited liability partnerships (LLPs), trusts, self-invested personal pensions( SIPPs) and SSASs (small self-administered schemes (SSASs)

There is a restricted appetite for off-shore companies, but options are available in the market.

What do I have to do to qualify?

Each lender in the market has different criteria and appetite which are liable to change over time. SMEs and property professionals will therefore find it vital to have a specialist broker amongst their ranks to help navigate and display the options that are available at a given time. The six key areas lenders examine when assessing an application are:

• Personal and business credit history

• Experience and background of the borrowers and/or the key people involved in the business (such as the management team)

• The type of property/business you wish to purchase or refinance

• The proposed loan-to-value (LTV)

• Affordability: can the property/business afford to repay the borrowing it has requested?

• Sustainability: is the income source to repay the loan sustainable for the full duration of the proposed loan(s) facility

Don’t worry if you can’t put a tick in all these boxes, as Swoop’s specialist brokers are on hand to work with you and support you in achieving your objectives.

What are the interest rates & other costs involved?

Interest rates and other deal costs vary from lender to lender. They typically start at c. 2% with the larger traditional banks, rising up to c.12% with niche lenders for high-risk transactions. Again, this is where a broker is important to navigate the market and present to you the most competitive solutions for your specific set of circumstances by approaching a wide range of lenders with your application.

Pricing is directly linked to a lender’s perceived risk in lending the money. The lower the risk of the deal going wrong or business failing, the lower the interest rate will be. The Swoop team is trained to work with customers to structure applications and present them to the market in the best light possible, therefore ensuring you benefit from the best terms lenders can offer.

When comparing commercial mortgages, you will need to factor in the associated costs, such as:

• Arrangement fees

• Valuation fees

• Legal fees

The following fees may also be applicable:

• Exit fees

• Commitment fees

• Monitoring fees

How long will it take to get a commercial mortgage?

Arranging a commercial mortgage or a property portfolio loan, depending on the purpose of the loan, typically takes between two and six months. The more complex the deal, the longer it takes. For example, a straight refinance of an existing property to release equity can be achieved in six to eight weeks. By contrast, the acquisition of a going concern can take more than six months to complete because of the level of legal and financial due diligence that may be required.

What information or documentation do I need to apply?

Registering with Swoop will enable you to speak to one of Swoop’s specialist commercial finance team. Once we’ve confirmed that your requirements are realistic and achievable for lenders to fund, we will require the following information to start looking for deals:

• Confirmation/proof of the income that will be used to repay the debt, such as the last three years’ financial accounts for a trading business and/or lease agreements for property investment applications

• Your latest management accounts (simply connect your accounting software to your account on Swoop and the integration will quickly find the information required)

• Last six months’ personal and business bank account statements to review account activity (connect your bank account via the UK’s open banking platform to your account on Swoop and we’ll gather the information automatically)

• Business plan and/or financial forecasts

• CVs or background summary of the borrowers or management team

• A&L (asset and liability) and I&E (income and expenditure) statements for all borrowers (20+ percent shareholders)

Check your Business Credit Score

Get your free business credit score.

The deals you can get from lenders depend on your credit score: the better your score, the cheaper it is to borrow.

Swoop has joined forces with Credit Passport to rate your business’ credit. The service is free and does not affect credit scores, unlike credit checks and failed loan applications which can harm your reputation.

What is a business credit score?

Business credit scores provide a snapshot of the financial health of an organisation and they are calculated by measuring payment and default history, levels of debt, legal problems, riskiness of the customer base and even the type of industry the company operates in. Banks, major suppliers, and commercial lenders will check a business’s credit score to understand the financial position of the company and its level of risk. Typically, higher scores increase an organisation’s borrowing options and reduce the rates they pay. Lower scores reduce the business’s loan options and increase the costs they pay.

Funding via Start Up Loans

Bring your business dreams to life with a start up loan.

The start up loans programme is a UK-wide, government-backed scheme that offers a personal loan, up to £25,000 to those that have a viable business idea but no access to finance. All successful loan recipients are offered free mentoring and access to exclusive business offers.

About the British Business Bank

Start Up Loans, a subsidiary of the British Business Bank, is a government-backed scheme designed to support UK businesses who struggle to access other forms of finance. Whether you’re taking the first steps or have been trading for a while and looking to grow, a start up loan can help you achieve your business goals.

What is a start up loan?

A start up loan is a business loan designed to help new UK businesses launch and grow. Like any other business loan, it’s a lump sum of capital that you pay back with regular repayments at a fixed interest rate.

Lenders will usually want to see details of:

• Your business plan

• Your turnover

• Your trading history (if you have any)

• Your founders

• Your projected earnings

You might find, however, that your business doesn’t currently meet the lending criteria for a UK government-backed start up loan If this is the case, create a Swoop account and speak to one of our advisors to discuss your options.

Swoop are part of a network of official start up loans referral partners across the UK who signpost new businesses to the scheme. We do not provide any business support as part of this partnership, and will not charge you for anything related to start up loans. We may receive a fee from the Start Up Loans Company if you subsequently obtain a loan having clicked on our link.

Many types of business can obtain a start up loan, from those still in the concept stage to those that have been trading for up to 36 months.

However, some areas of industry are excluded. Companies, partnerships, or sole traders that engage in Illegal activities such as drugs, weapons, and chemical manufacture; FCA-regulated activities such as banking and money transfer services; gambling and betting; pornography; charities; private investigators without the correct license; property investment; and agents for third parties where your company does not receive most of the revenue it creates, are some of the businesses that are not eligible for a start up loan.

To obtain a government-backed start up loan, eligible applicants must meet the following criteria:

• You must be at least 18 years old

• You must live in the UK

• You must have the right to work in the UK

• Your business must be based in the UK

• You must prove that you were unable to acquire a loan from alternative sources

• You must prove that you can afford the loan repayments

• Your business must have been trading for no more than 36 months

• Start up loans can be used for most legitimate business purposes if they support the early growth of the company, form part of the business plan and are shown in the financial forecasts. Financial support from £500 up to £25,000 is available, with a maximum of £100,000 possible for a single entity if four business partners or directors each personally apply. (Maximum per applicant is £25,000).

Your business ownership is unaffected if you take out a government start up loan.

How do start up loans work?

Start up loans are designed to bring a seed or early-stage business to life. They inject early money to pay for concepts, testing, designs, prototypes, machinery, plans, legal needs, premises, marketing, staff costs and more. Often, a start up loan is the only cash a company has when it first begins to operate, and these loans are often provided when the business is little more than an idea.

The UK Government-backed start up loan scheme, offered by the British Business Bank, provides funds without requiring security, a personal guarantee, or a stake in the business. The loans are also provided at a low rate of interest and with up to five years to repay.

Funds from private investors, (‘angels’) are not loans, they are investments, even if they provide the same outcome as a loan. Be aware that some investors may ask for a large share of your business as well as regular payments in turn for their cash

Choosing the right source of start up loan is important for any new business. The sum required, the length of time the money must last, the company’s ability to repay, and the retention of ownership must all be considered. Most importantly, time and effort should be put into the business plan to ensure the company has sufficient capital to reach the stage when revenues arrive.

What types of start up loans are there?

The primary source for start up loans is the UK Government-backed start up loan scheme. These loans are unsecured, enjoy a lower rate of interest than typical business loans offered by commercial lenders, and are provided by the British Business Bank. Swoop are part of the UK-wide network of referral partners for government start up loans. Apply today to discover if your business is eligible for this type of loan.

Other options for start up funds include:

• Traditional business loans

• Asset-backed loans

• Merchant cash advances

• Funding from Angel investors

• Business grants

• Business credit cards

Register with Swoop to find the best option for your immediate business needs.

What are UK Government start up loans?

Government-backed start up loans are a different kind of funding. Commercial lenders usually ask for security when providing a business loan. This means you must provide collateral to cover the loan if you default. You will also need to provide a personal guarantee. UK Government start up loans are unsecured personal loans. You do not need to supply collateral or a personal guarantee.

Start up loans are available from £500 up to £25,000, with a maximum of £100,000 possible for a single company if four business partners or directors each personally apply (maximum per applicant is £25,000). Repayment is made in affordable instalments and subject to a fixed interest rate of 6% per year. You can repay the loan over a period of 1 to 5 years. There is no application fee and no early repayment fee.

The UK Government also provides free support and guidance to help write your business plan, and successful loan applicants get up to 12 months of free mentoring. Start-up loans from sources other than the government-backed scheme may be subject to different terms and conditions. Please contact us to discuss these alternatives.

What are the advantages of a start up loan?

Start up loans enjoy significant advantages over other types of borrowing:

• They enable you to start your business

• They usually allow you to retain full or majority ownership

• Government start up loans require no security or personal guarantee

• They often have lower interest rates and may enjoy deferred payments

• Lenders provide the loan based on the business plan and financial projections. They do not expect to see historical business accounts

• Start up loan providers will consider riskier businesses or ideas than most traditional lenders

• Start up loans let you build business credit

What are the disadvantages?

• The application criteria for the government scheme can be restrictive and slow

• Non-government backed loans can be expensive and may require collateral

• Start up loans can put your personal credit rating at risk

What are the interest rates and fees?

Government-backed start up loans are subject to a 6% fixed rate of interest. These loans can be paid back over 1-5 years and have no application or repayment fees.

Loans from commercial lenders are usually more costly than the government scheme. Interest rates and fees vary and are based on the level of risk, credit scores, and the availability of collateral.

What can the loan be used for?

Government-backed start up loans can be used to start a new business or grow an existing business that has been trading for less than 36 months. The loan can be spent on a wide range of expenses related to your business, like employees, equipment, stock, premises, and marketing expenses. Where you intend to spend the loan and what it will pay for must be included in your business plan and cash flow forecast and the plan must explain how the loan will help you start and/or grow your business.

Some activities cannot be funded with a start up loan. These include debt repayment, training qualification and education programmes or investment opportunities that do not form part of an ongoing sustainable business.

Can I get a start up loan with bad credit?

Possibly. During the application process, the lender will carry out a personal credit check to ensure you can afford your loan. Although bad credit doesn’t necessarily disqualify you from being eligible for a start up loan (all applications are assessed individually), it will be considered during the assessment process. If the lender is not satisfied that you will be able to afford the loan, your application may be rejected.

Do start up loans require a personal guarantee?

Government-backed start up loans do not require collateral or a personal guarantee. Start up business loans from commercial lenders may ask for your personal guarantee or demand collateral to cover the loan in the event of your default.

Can I get a start up business loan without a credit check?

No. The government backed Start-Up Loans scheme requires a review of the applicant’s personal credit history. You must expect all commercial lenders to do the same.

If you have poor credit, that does not necessarily disqualify you from being eligible for a start up loan (all applications are assessed individually). Additionally, Swoop works with lenders who specialise in loans for applicants with poor credit. Even if you’ve been turned down elsewhere, it may still be possible to obtain funds for your new business. Register with us to learn more about these alternatives.

Funding via R&D Tax Credits

An R&D tax credit is a cash payment from the government to encourage companies to conduct Research & Development other innovative activities.

R&D projects must relate to science or technology, however HMRC’s definition is broad and includes investment into technology, IT systems, data and cloud computing. The range of businesses carrying out qualifying activity is ever expanding. Various events over the last two years, notably Covid-19 and Brexit have meant companies have had to step up their innovation to overcome restrictions.

If you’re building a startup or developing processes and products to meet a demand in an evolving market, it’s likely that you’ll qualify for research & development tax credits. R&D tax credits can be claimed for up to two years prior to the date of your claim. This gives you some time to get your business organised and make sure that all qualifying activities and costs are captured.

Our trusted specialists help you maximise your claim by identifying innovative activities while simplifying the process and taking care of your claim for you.

Compare Business Bank Accounts

Tired of being overcharged and underserved on your business bank account?

As a smart business no doubt you review your regular suppliers to ensure you’re getting the best value and the best service levels possible.

So why don’t more businesses do this with their banks? The truth is that many businesses are being overcharged – approximately £700 per account – and also underserved by their banks, so we’re here to help put that right.

Try our free, quick and simple business bank account comparison checker. Compare fees and services across all the key banks to ensure you’re matched with the best bank(s) for your business.

When it comes to banking, businesses are reluctant to change, fearing hassle, charges, or interruption to services. The good news is that this is no longer the case, it’s a quick and painless process, and switching business current accounts will soon be as common as switching any other service provider.

Swoop has access to 72 business current account offerings across 16 banks. This means we can quickly and securely analyse your usage patterns to determine which bank you would be better off banking with, and whether additional accounts to manage specific transactions, for example deposits, would offer you savings. Register here to receive your tailored banking report.

To help you find the best current account for your business, it’s worth considering the following points:

Cost: Fees and charges will vary depending on the account you choose. Some business bank accounts charge monthly or annual fees, while others don’t. There may also be charges for certain transactions such as cash payments or international transfers.

Transaction limits: Some banks offer a set number of free transactions per month and anything over this will be charged a fee. For example, you may be able to carry out five UK transfers per month, but if you go over this number you’ll have to pay a fee.

Managing your account: If you’d prefer to be able to go into a branch to pay in cash and cheque payments, you might better off looking for a bank with a local branch. However, many digital or app-only banks allow you to deposit cash at Post Office branches (sometimes with a fee).

Size of business: Some banks offer different account options depending on the size of your business and whether you’re a start-up or more established company. Look for an account that’s likely to best serve your business needs.

Links to accounting software: A number of business bank accounts enable you to link up with accounting software such as Xero, QuickBooks, FreeAgent and Sage.

Invoicing services: You may also be able to benefit from invoicing services which create and send invoices and help you to better organise your accounts.

International banking: If you regularly send money overseas or travel abroad, look for an account that offers competitive international transfer fees and low/no fees for using your card abroad.

Overdraft options: Does your business go into its overdraft from time to time? If so, look for an account with a generous overdraft facility and low fees.

Other financial products: If you need other products like a a business loan or a grant. Speak to a Swoop expert to find out your options.

Credit checks: Some app-based providers won’t run a credit check as part of the application process which can make them a good option for those with bad credit. Use our tool to compare business accounts for those with bad credit to see which banks don’t require a credit check to apply.

Business bank account fees explained

When comparing business bank accounts you’ll need to factor in the cost of any fees – this could be a monthly fee for using the account or a charge for account transactions. It’s therefore important to read the terms and conditions of your chosen account carefully.

Some of the fees you may come across include:

• Monthly or annual account fee: This is a flat fee that some bank accounts charge per month or per year simply for having the account. Some banks will waive this fee for the first 12 to 18 months.

• Electronic payments (in or out): This includes Faster Payments to other individuals or companies, bill payments, direct debits and standing orders. Some business bank accounts won’t charge you for these transactions, while others might give you a set allowance per month and then charge per transaction if you go over this limit.

• Cash or cheque payments (in or out): You could be charged a flat fee or percentage fee for deposits and withdrawals via a bank branch or at a Post Office counter. Some banks also charge for depositing a cheque.

• Additional payments and services: This can include services such as making a CHAPs payment or issuing a banker’s cheque.

• International transactions: Fees may be charged for international payments, such as a SEPA or SWIFT payment, from your bank account to one overseas, as well as for receiving an international payment into your account. You may also have to pay a fee for purchases or cash withdrawals made on your bank card overseas.

• Overdraft charges: Some bank accounts charge an overdraft set-up fee as well as a daily fee, or you may be charged interest.

Ensure you’re getting the best deal with our quick and simple comparison tool.

Small business energy help: What can I do to reduce my energy bills?

Whilst the UK government is doing what it can to help UK businesses struggling with their energy costs, there’s a chance you could switch energy providers and save.

Get in touch to discuss how Swoop can help bring energy bills down and potentially save on VAT.

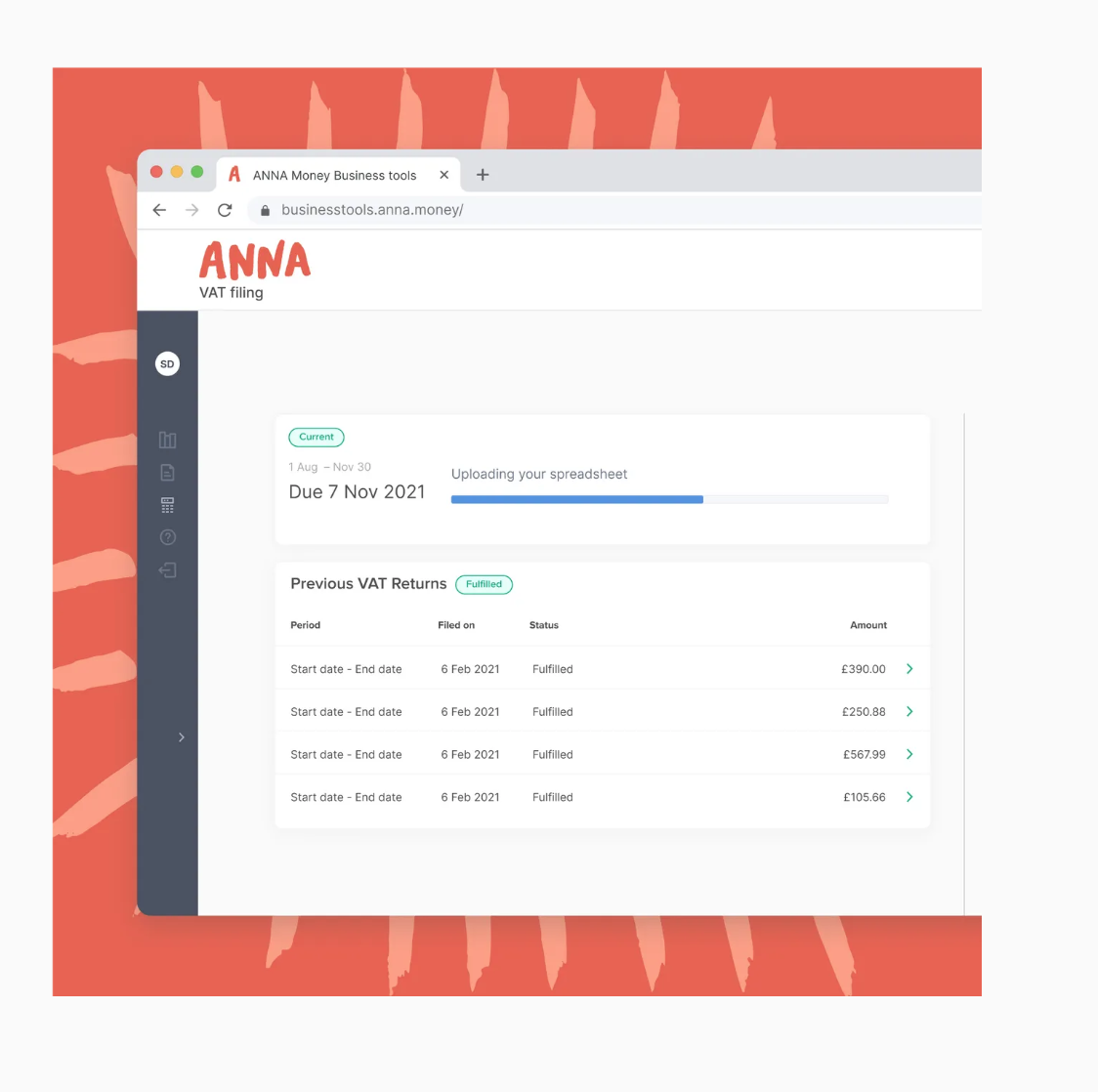

Quick & Easy VAT Filing: ANNA Money makes VAT simple.

We’ve partnered with ANNA Money to help small businesses and freelancers sort their admin. It’s an incredibly easy way to file your VAT Return for free.

Just register your business with Making Tax Digital, connect to HMRC and file your VAT Return from an XLS sheet.

With the VAT Return automatically calculated in the spreadsheet, all the hard work is done for you. Or, you can use your own sheet.

Swoop provides an authentic blend of support & understanding to Holy Moly Dips

Client

Holy Moly Dips

Sector

Food & Beverage

Project

Financing, trade financing, and tier-one investment

Quote

"Swoop, everything they do helps drive the UK’s economy"

Gaz Holy Moly Dips

Swoop’s “glass half full” approach enables pub chain to seize opportunity to boost profits

Client

Pitcher Pub Group

Sector

Food & Beverage

Project

After Pitcher Pub Group’s existing bank declined the facility request, Swoop stepped in to offer an alternative.

Approach

How did Swoop secure the refinancing for this family run pub group?

Christoper and Marion Pitcher have been at the helm of their family-run pub group for 17 years. They were approached with the opportunity to switch suppliers, being offered a fee incentive and a reduced cost on beer supply. This was more than peanuts – the switch would unlock significant additional profitability that would go straight to the bottom line and the Pitchers realised this was too good an opportunity to miss.

While the decision was easy, carrying out the plan was difficult due to their circumstances:

The Pitchers had an existing loan to repay with their current supplier

Their existing bank declined to refinance the loan facility with the current supplier, citing the reasons that it was forecast-led, as well as the bank’s lack of appetite to support the pub sector

Their existing bank was also reluctant to release the public houses held as security on the loan, despite the loans having been repaid

When the bank called time on the Pitchers’ credit line, they sent for Swoop.

Ann Marie Swift, Commercial Finance Manager at Swoop, took on the case with a thirst to find lenders that were looking to support the pub sector. Through gaining a thorough understanding of the proposed deal and the assets of the Pitcher Pub Group, Ann Marie demonstrated the improvement in profitability from switching suppliers would comfortably support the refinance of the existing brewery loan. Furthermore, she argued that the refinance should not be considered as ‘projection led’ due to the fact there would be no significant uplift in turnover; this was purely a case of unlocking additional profitability from existing turnover.

Swoop’s approach is to understand individual cases by staying close with all stakeholders at every stage of the journey. The team’s in-cider knowledge of the financial products on the market allows them to overcome the usual obstacles that see customers being turned away by their existing banks.

No half measures

Ann Marie secured a speci-ale deal for Pitcher Pub Group. The client successfully refinanced their brewery loan with a lender supplied by Swoop and were able to switch suppliers, resulting in a direct gain on the profit margin.

The additional profitability means that the Pitchers can reinvest in their portfolio of pubs and optimise new opportunities at a time when the sector has found it particularly difficult to continue trading, let alone improve their offer.

No half measures

Ann Marie secured a speci-ale deal for Pitcher Pub Group. The client successfully refinanced their brewery loan with a lender supplied by Swoop and were able to switch suppliers, resulting in a direct gain on the profit margin.

The additional profitability means that the Pitchers can reinvest in their portfolio of pubs and optimise new opportunities at a time when the sector has found it particularly difficult to continue trading, let alone improve their offer.

On always challenging the market status-quo and finding our customers the best deals, Ann Marie says:

‘We often see clients accepting their bank’s response and missing out on opportunities. It’s rewarding to be able to challenge constructively and reveal other options. We can find a better solution that ultimately delivers an outcome that can impact a customer’s business growth aspirations.’

The moral of the story: if your bank has you over a barrel, Swoop will pull out the stops to ensure you have a reason to break out the champagne!

Quote

‘Ann Marie was excellent at Swoop. She was able to refinance three of our pubs. I cannot thank her and the team enough and can only recommend her services.’

Christoper Pitcher

Changes in 2023 – Prepare for the end of the fiscal year

This webinar will lead you through all of the updates you need to know as a business owner ahead of the financial year end. Hosted by business experts Andrea Reynolds, CEO & Co-founder, Swoop Funding and Ciaran Burke, COO & Co-founder, Swoop Funding.

In this webinar we will cover the following topics:

– Changes in R&D tax credits

– SEIS and EIS Tax Relief

– Energy cost support for businesses

– Corporation tax

– Super deduction allowance

– Annual investment allowance

How to grow your business safely in

the "new normal"

PR Masterclass with JournoLink

"Amazing service with a super professional team. Don't waste your time by looking anywhere else but the Swoop platform. They helped in a seamless way and got the job done in 48 hours!"

Dave Stapleton

Bua Fit